After two painful years of premium spikes, Florida drivers are finally seeing relief. Over the past 60–90 days, state regulators and local outlets have reported actual rate cuts from the biggest carriers—a sharp turn from 2023’s surge. The Florida Office of Insurance Regulation (OIR) says the top five personal‑auto groups, which write about 78% of the market, indicate an average rate change of −6.5% in 2025, with some filings as deep as −11.5%. To make the most of this window, see these smarter auto insurance choices in 2025 for real savings and better coverage.

This article compiles recent developments from primary and reputable sources: OIR bulletins, Insurance Journal coverage, and reporting from WJXT/News4JAX and WFTV in early August 2025. We explain what’s changing, who’s cutting, where exceptions exist, and the steps you can take now to capture savings while keeping solid protection.

What’s actually changing in Florida right now

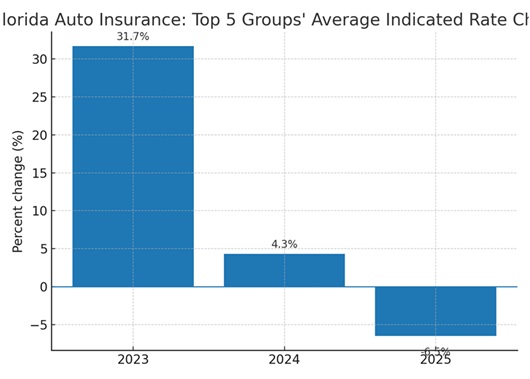

On July 29, 2025, the OIR announced that the top auto insurers in Florida are indicating an average −6.5% rate change for 2025, down from an average +4.3% in 2024 and +31.7% in 2023. The OIR also highlighted improved underwriting results and a sharp drop in personal‑auto liability loss ratios. Local stations quickly amplified the news: on August 5, WJXT/News4JAX reported rate decreases by GEICO (−10.5%), Progressive (−8.1%), and State Farm (−6%), and on August 4, WFTV summarized the same −6.5% average figure and tied it to recent litigation reforms.

Why rates are falling: reforms, loss ratios, and more shopping

Florida’s litigation reforms in 2023 curtailed one‑way attorney fees and eliminated assignment of benefits (AOB) for auto‑glass claims. WJXT reports glass‑claim lawsuits dropped roughly 80% year over year, easing loss adjustment expenses. OIR data shows personal‑auto liability loss ratios falling to around the low‑50s in 2024—among the lowest in the nation. At the same time, shopping activity has surged: a LexisNexis report cited by OIR notes auto‑insurance shopping rose 16% year over year in Q1 2025, with nearly half of active policies shopped at least once in the last year—pressure that can push carriers to compete on price.

Not every filing is a cut: caveats, profit caps, and variability

Relief is real—but it’s not uniform. Some companies are still rebalancing, and a handful of filings may move in the other direction to catch up with past losses. One noteworthy development: Insurance Journal reports Progressive could exceed Florida’s three‑year statutory profit cap for personal auto (2023–2025), which may trigger refunds or credits to policyholders under Florida statutes 627.066 and 627.915. That story underscores how quickly results have turned after years of steep claims costs—and why your renewal could look different from your neighbor’s.

Graphic: Florida’s rate arc since 2023 (top five auto groups)

Average indicated rate change: +31.7% (2023), +4.3% (2024), −6.5% (2025). Source: Florida OIR, July 29, 2025.

How Florida drivers can benefit now

· Shop before renewal and after: quote 30–45 days ahead and again if your driving changes mid‑term.

· Verify annual mileage and garaging. If you drive less or moved, ask your carrier to re‑rate your policy.

· Consider telematics. Safe‑driver programs can shave additional points off already‑lower base rates.

· Right‑size deductibles (with an emergency fund). Higher deductibles reduce premium; know your out‑of‑pocket.

· Audit coverages line‑by‑line. Ensure medical payments, UM/UIM, and rental reimbursement fit your situation.

· Ask for a pre‑purchase insurance quote on any vehicle you’re considering—ADAS repairs can swing premiums.

For a plain‑English refresher on today’s market dynamics, see the evolving auto‑insurance landscape—what drivers need to know in 2025.

Summary table (rendered in Word)

| Item | 2025 Status | Source / Notes |

| Average indicated change (top 5 groups) | −6.5% in 2025 (vs. +4.3% in 2024; +31.7% in 2023) | Florida OIR |

| Carrier examples | GEICO −10.5%; Progressive −8.1%; State Farm −6% | WJXT/News4JAX |

| Profit‑cap angle | Progressive could exceed statutory limit for 2023–2025; refunds/credits possible | Insurance Journal |

What to watch next (late‑2025)

• Hurricane season: Loss experience from late‑summer and fall storms can still influence 2025–2026 filings.

• Litigation trends: If lawsuit volumes stay lower (especially auto glass), lower loss‑adjustment expenses support continued stability.

• Shopping intensity: With more consumers switching, expect sharper competition on price and underwriting appetite.

• Parts and repair costs: If national repair costs re‑accelerate (e.g., tariffs or supply shocks), they could trim part of Florida’s gains.

• Refunds: Watch OIR for any excess‑profits determinations that translate into credits or checks for drivers.